xSeptember211856.jpg)

Isle of Man Treasury has launched a new fund regime to try and further increase the Island's already burgeoning fund sector.

Funds under administration and management here have grown from $7 billion in 2003 to a current total of over $50 billion and are forecasted to double over the next three years.

The initiative follows the publication of the Smith Report in February 2007, which announced the Island's intention to position itself as the preferred location for the incorporation, domiciliation and management of institutional funds in the global alternative funds industry.

As a result of the recommendations, Treasury Minister Allan Bell (pictured) will take three new Orders of Legislation to Tynwald next month, effective from November 1.

They provide for the new Specialist and Qualified Funds and transitional/retention arrangements for Experienced Investor Funds.

Isle of Man Finance's Brian Donegan anticipates the new initiatives, when coupled with the existing taxation advantages, will position the Island as the jurisdiction of choice for fund management and administration.

Five-year capital project plan 'essential for construction industry'

Five-year capital project plan 'essential for construction industry'

Treasury 'content' with Steam Packet oversight arrangements

Treasury 'content' with Steam Packet oversight arrangements

Government publishes updated insurance sector money laundering risk assessment

Government publishes updated insurance sector money laundering risk assessment

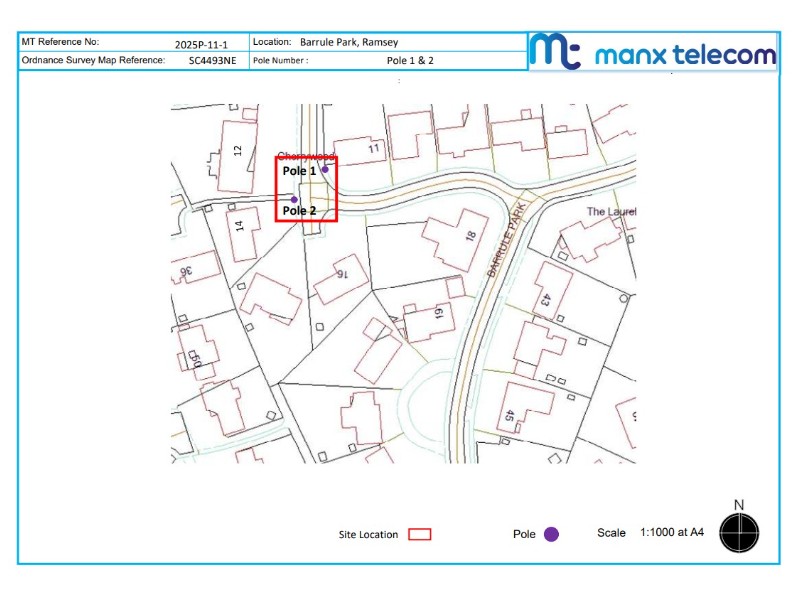

Application for fibre poles in Ramsey estate refused

Application for fibre poles in Ramsey estate refused