This is a paid promotion on behalf of Digital Isle of Man

This year’s Isle of Man Innovation Challenge introduces InsurTech as a key theme within the FinTech category, aiming to transform how insurers connect with customers and deliver services.

This year’s Isle of Man Innovation Challenge, led by Digital Isle of Man in collaboration with Finance Isle of Man and Business Isle of Man, showcases InsurTech solutions for the first time, highlighting the Island’s commitment to evolving its financial services sector through innovation.

The 2025 Challenge has drawn over 100 international registrations and focuses on three key categories: FinTech, Cleantech and Data & AI.

Within FinTech, InsurTech is a major new highlight, inviting pioneering solutions to help insurance companies better engage with their customers and deliver smarter, tech-driven services.

InsurTech, or insurance technology, is a fast-growing global field using AI, data analytics, automation, and digital tools to enhance insurance delivery.

From automating claims to delivering tailored advice via mobile apps, the sector is reshaping how providers engage with customers.

Simon Pickering, Head of Insurance and Pensions at Finance Isle of Man, says:

“The Isle of Man has a proud tradition in insurance, but like many mature sectors, maintaining engagement with policyholders over time can be challenging. By introducing InsurTech as a focus within this year’s Innovation Challenge, we are creating an opportunity to explore how emerging technologies can reconnect providers with their customers, improve service delivery, and future-proof the industry. We’re looking for practical, people-focused solutions that support both business innovation and positive consumer outcomes.”

The Isle of Man Financial Services Authority supports the development of InsurTech by aligning regulation with technological change while maintaining consumer protection.

Its involvement in initiatives such as Insurtech IOM and this year’s Innovation Challenge reflects this approach.

The FinTech category features five international finalists whose innovations span compliance automation, ESG-aligned crypto, AI-driven customer engagement, unstructured data processing and proptech:

- Binderr (Malta): A professional and financial services marketplace streamlining compliance and onboarding.

- Zumo (UK): Offers crypto solutions that align with ESG goals by offsetting emissions.

- Spixii (UK): Delivers Conversational Process Automation to improve customer service for insurance and banking.

- Own Group (Isle of Man): A rent-to-own platform helping renters transition into homeownership.

- Staple AI (Singapore): Uses AI to process unstructured financial documents in over 300 languages with high accuracy.

Finalists will showcase their solutions at the Innovation Challenge Finale Day on 26 June 2025 at the Comis Hotel, where industry leaders, government representatives and the public will gather to explore the future of finance and technology.

To find out more about the Challenge and the full list of finalists, visit www.innovationiom.com.

Product recall issued after asbestos found in sand

Product recall issued after asbestos found in sand

Island set for 'Uber Eats style' delivery service

Island set for 'Uber Eats style' delivery service

MUA reviewing plans for floating solar scheme

MUA reviewing plans for floating solar scheme

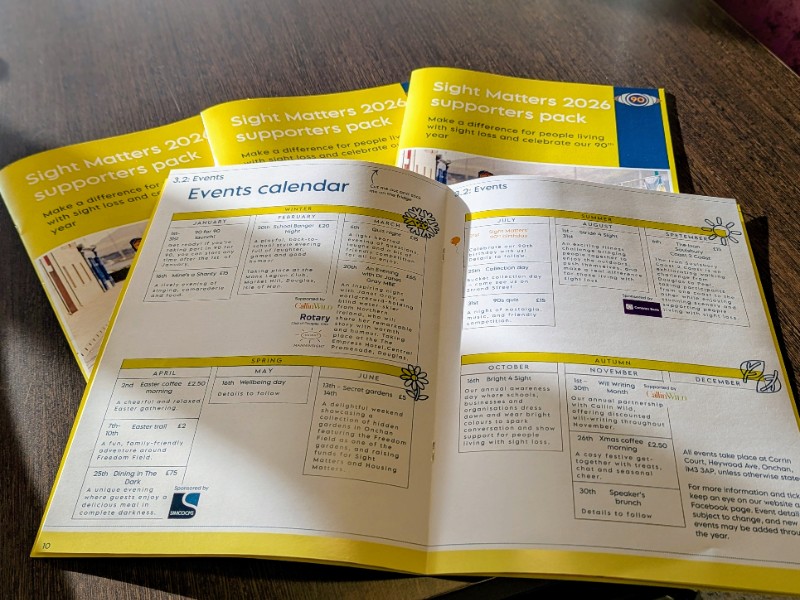

Sight Matters marks 90 Years with packed programme of events

Sight Matters marks 90 Years with packed programme of events