Treasury minister shares data from Audit Advisory Division

The number of financial irregularities reported to Treasury has increased year-on-year, according to data dating back to 2021.

Information from the Audit Advisory Division has been shared in response to a Tynwald Question for Written Answer to Treasury Minister Alex Allinson.

The types of financial irregularity are separated into the following categories: bribery and corruption, budget/ income management, contractual, procurement governance, theft/ fraud, payroll/ pension management, operational, and internal error.

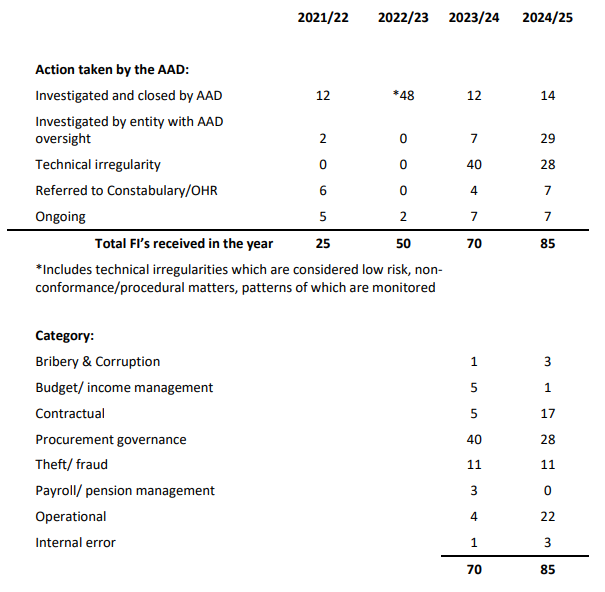

The number of reports increases from 25 in 2021/22, to 50 in 2022/23, 70 in 2023/24 and up to 85 across 2024/25.

A breakdown of the types of financial irregularities reported shows the majority across the past two years relate to procurement governance.

Three reports of 'bribery & corruption' in 2024/25

In the last financial year alone there were 28 reports which fell into that category, while there were 22 reports of FI's classed as 'operational', 17 in respect of 'contractual' concerns, 11 concerning 'theft/ fraud' and three concerning 'bribery and corruption'.

Action taken by the AAD remains ongoing in respect of a small number of reports across each of the last four years.

Table: Data provided in response to the question "How many financial irregularities were reported to the Treasury’s Audit Advisory Division by Government Departments, Boards, Offices and arm’s length bodies since April 2021, giving in each case a) the category of irregularity, b) the area of irregularity, c) the value, d) any finding by the Division, e) whether referred for further action, and f) any action taken if irregularity upheld."

In response to the question from Onchan MHK Julie Edge, Minister Allinson says: 'AADs examinations help to scrutinise public spending, hold government to account, drive improvement in public services and protect the public against dishonesty. This work serves a substantial public interest.

'Investigations include Financial Irregularities where information provided on the form is ‘provided in confidence’ and investigated under a statutory function in the public interest of preventing or detecting unlawful acts and preventing the public against dishonesty.

'Personal data may be collected as part of the report and/or investigation and may be shared for the detection or prevention of crime.

'The AAD processes data whereby individuals have raised concerns relating to, but not limited to: criminal activity; financial malpractice or fraud; financial mismanagement or corruption; material breaches of regulatory standards; bribery; improper conduct or unethical behaviour, and will carry out an investigation accordingly. Investigations may gather documentation and information from IOM Government Departments, Members of House of Keys and those involved in the subject matter of any investigation.

'Data collected as part of the investigation may be shared with other Designated Bodies as defined in the Treasury Financial Regulations and the Isle of Man Constabulary to ensure completeness of the investigation'

Your can find the full response to the written answer HERE.

Care funding reform report delayed following ministerial change

Care funding reform report delayed following ministerial change

Charity plans baby loss memorial garden at Noble's Hospital

Charity plans baby loss memorial garden at Noble's Hospital

New rights for neonatal care leave and carer's leave on the way

New rights for neonatal care leave and carer's leave on the way

Manx Wildlife Trust launches new internship programme

Manx Wildlife Trust launches new internship programme