590p per share offer

There's been a £3 billion takeover bid for a Manx-based UK-listed online payments group, which focuses on the online gambling industry.

Paysafe's board is considering a 590p per share in cash buyout from CVC Capital Partners, and Blackstone - two groups - one offer.

The valuation represents 14 times company earnings before interest, taxes, depreciation and amortisation.

The groups first approached Paysafe in May, but their offer was rejected.

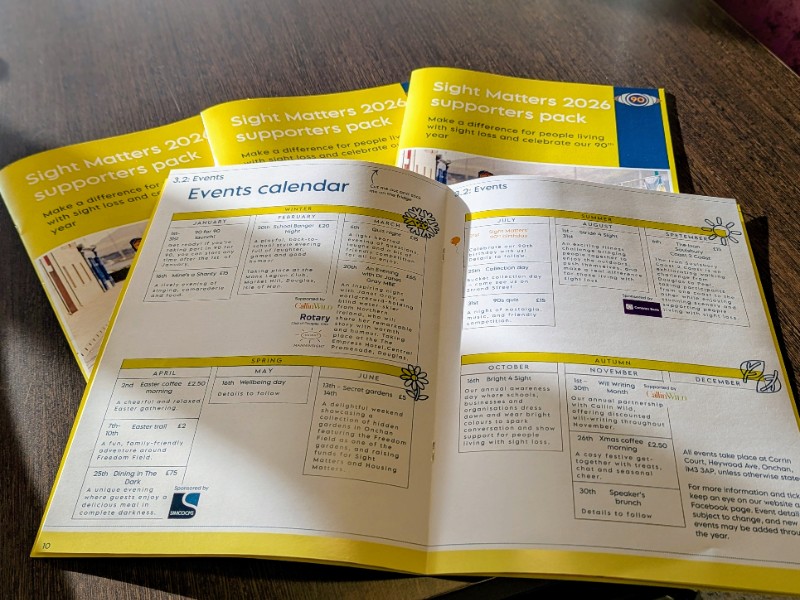

Sight Matters marks 90 Years with packed programme of events

Sight Matters marks 90 Years with packed programme of events

Minimum Wage Committee agrees with rate change

Minimum Wage Committee agrees with rate change

Reduction in minimum wage rise "positive across the board", says Chamber president

Reduction in minimum wage rise "positive across the board", says Chamber president

Changes to IOM Post Office operations are coming, but no closures

Changes to IOM Post Office operations are coming, but no closures